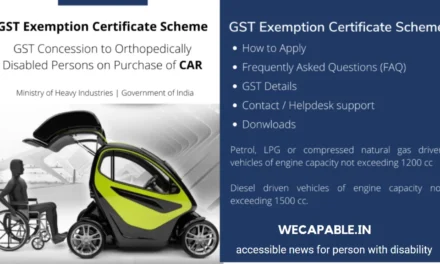

The Indian Government’s Ministry of Finance has granted a reduced Goods and Services Tax (GST) rate of 18% and waived the additional cess on motor vehicles designed for individuals with orthopedic physical disabilities.

What is the GST Concession?

The GST concession on cars for PwD is a tax exemption that allows PwD to purchase cars at a reduced rate. The concession applies to cars that are specifically designed for PwD, such as those with hand controls, wheelchair lifts, and other modifications. The GST concession is applicable to both new and used cars, and the amount of the concession varies depending on the type of car purchased.

Eligible for the GST Concession For PwD ?

The GST concession is available to any PwD who meets the following criteria:

- The person must be a resident of India.

- The person must have a valid disability certificate issued by a government-recognized medical authority.

- The discounted duty rate for individuals with orthopedic physical disabilities is available to those who have a disability of 40% or more, regardless of whether the person operates the vehicle personally or not.

Vehicles Permitted For GST Concession For PwD

The benefit can be utilized for the subsequent categories of cars (manual/automatic) with a maximum length of 4000 mm:

- Cars powered by petrol, LPG, or compressed natural gas, with an engine capacity not surpassing 1200 cc.

- Cars driven by diesel, having an engine capacity of 1500 cc or lower.

Documents Required

The Department of Heavy Industry has established guidelines for issuing certificates to handicapped individuals to enable them to avail of certain benefits. According to these guidelines, individuals seeking GST concessions for PwD must provide the following documents in the specified format:

- The application for the benefit must be submitted before the purchase of the vehicle. It is important to note that GST refunds after vehicle purchase will not be possible.

- To apply online, visit https://dhigecs.heavyindustry.gov.in/. The applicant needs to provide details about the vehicle model, the dealer from whom the vehicle will be purchased, and the name of the Regional Transport Office (RTO) where the vehicle will be registered.

- Applicants must possess a Unique Disability Card issued by the Government of India, a Disability card issued by the state or district administration clearly specifying the nature and percentage of disability, or a medical certificate signed by a medical practitioner and countersigned by a Civil Surgeon or an equivalent rank from a Government Hospital, in the prescribed format.

- An affidavit from the applicant is required, confirming that they have not availed of this concession in the last 5 years and that they will not sell the vehicle with GST concession for a period of 5 years, in the prescribed format.

- Other essential documents include the PAN card, Aadhaar card, and a photograph of the applicant.

- The processing of these applications is expected to take approximately 4 weeks.

The certificate issued will be valid for six months from the date of issue. The vehicle must be purchased within this specified timeframe. The Department of Heavy Industry (DHI) will send a copy of the certificate to the dealer, the original equipment manufacturer, and the RTO for record-keeping and cross-verification purposes.

Car dealers are required to apply concessional GST rates to individuals who have been issued the certificate. The invoice for all such vehicles purchased should bear the hologram symbol “To be registered as the Adapted vehicle.” These vehicles will be registered as “Adapted vehicles” in accordance with the Motor Vehicle Act of 2019. Additionally, the applicant must inform DHI about the vehicle purchase within 30 days of vehicle registration.

If the certificate expires before making a purchase, what steps should be taken?

The GST concession certificate’s validity duration has been extended from 3 months to six months starting from July 2022. This extended validity will remain in effect for a period of two years, until June 30, 2024.

If individuals wish to request an extension of the validity period for a previously issued GST concession certificate after it has expired, they are required to provide the following documents in a single PDF file:

- An application requesting an extension of the validity period, accompanied by a detailed explanation for not utilizing the GST concession certificate (to be written on plain paper and signed by the applicant).

- A copy of the original GST concession certificate.

- A letter from the dealer confirming that the vehicle was not delivered to the applicant.

Please note that these documents should be submitted or emailed as a single PDF file after the expiration of the existing certificate.

What should be done if the certificate expires without a purchase being made?

The validity duration of the GST concession certificate has been extended from 3 months to six months. This extended validity will remain in effect for a span of two years.

To request an extension of the validity period for an already issued GST concession certificate after its expiration, the following documents should be submitted or emailed as a single PDF file:

- A formal application for an extension of the certificate’s validity period, including a detailed explanation for not using the GST concession certificate. This explanation should be provided on plain paper and signed by the applicant.

- A copy of the original GST concession certificate.

- A letter from the dealer confirming that the vehicle was not delivered to the applicant.

Please note that these documents should be sent after the existing certificate has expired.

Where should one file a complaint if a car dealer or RTO fails to honor the GST certificate supplied by DHI?

If such a situation arises, individuals can report the issue to the Federation of Automobile Dealers Association of India (FADA) and the Ministry of Road Transport & Highways for resolution.

For useful tips to fill the application, click here

For the complete guidelines and prescribed formats, click here

For Frequently asked questions on the scheme, click here

To check Approval status of your application, click here

Source : Department of Heavy Industry, Ministry of Heavy Industries & Public Enterprises

Benefits of the GST Concession

The GST concession for PwD on cars provides a number of benefits to those who are eligible. These include:

- Reduced cost of car ownership: The GST concession reduces the cost of car ownership for PwD, making it more affordable for them to purchase a car.

- Greater access to mobility: The GST concession provides PwD with greater access to mobility and independence, allowing them to travel more freely and with greater ease.

- Increased employment opportunities: The GST concession makes it easier for PwD to find employment, as they are now able to travel to and from work more easily.

Conclusion

The GST concession for PwD on cars is a welcome move by the Government of India, as it provides PwD with greater access to mobility and independence. The concession reduces the cost of car ownership for PwD, making it more affordable for them to purchase a car. Additionally, it provides them with increased employment opportunities, as they are now able to travel to and from work more easily. The GST concession is a step in the right direction towards providing PwD with greater access to transportation and independence.

For More Enquiry

Shri M. Subramaniyan

Under Secretary

Ministry of Heavy Industries

Room No. 379 Udyog Bhawan, Rafi Marg, New Delhi

Email id: m.subramaniyan@nic.in

Phone no: 011-23061531

helpdesk.gecs-dhi@gov.in

divya.patel94@gov.in

simmi.narnaulia@nic.in

Working Hours: Monday-Friday(9:00 AM – 05:30 PM)