The primary aim of the Divyangjan Swavalamban Scheme is to support Person with disabilities in need by offering reduced-interest loans to enhance their economic and overall empowerment.

Purpose for Divyangjan Swavalamban Scheme

Divyangjan Swavalamban Scheme offer subsidized financial assistance to individuals with disabilities (as per the definition outlined in the PwD Act, 2016, or its subsequent revisions) for the following purposes:

- Initiating any activity that directly or indirectly contributes to income generation or aids individuals with disabilities in their overall journey towards empowerment.

- Enrolling in higher education beyond the 12th grade (including undergraduate, postgraduate, professional programs, and other courses endorsed by UGC/AICTE/ICAR/Government, etc.)

- Participating in vocational training or skill development programs (such as ITI, diploma courses, or any other training that enhances employment prospects or self-employment skills)

- Buying and/or installing assistive devices, customizing, retrofitting, or converting existing machinery, equipment, or vehicles into disability-friendly modes.

Benefits

People with disabilities won’t need multiple document copies; this card will record all essential information comprehensively.

- Simplifying the monitoring of applicants’ physical and financial advancement across all levels of the implemented hierarchy, including village, block, district, state, and national levels, will be achievable with the assistance of the UDID card.

- The UDID card will serve as the sole means of identifying and verifying disabled individuals to access various future benefits.

Eligibility Criteria

- Individuals with a disability of 40% or more, as per the definition in the PwD Act, 2016, or its revisions, and who are citizens of India, are eligible.

- Applicants must be 18 years of age or older. However, for individuals with mental retardation, the eligible age is 14 years or older. The age criteria do not apply to educational loans. An age certificate issued by an authorized competent authority appointed by the State government, as specified in the 10th certificate, or any government-issued certificate, is the necessary documentation.

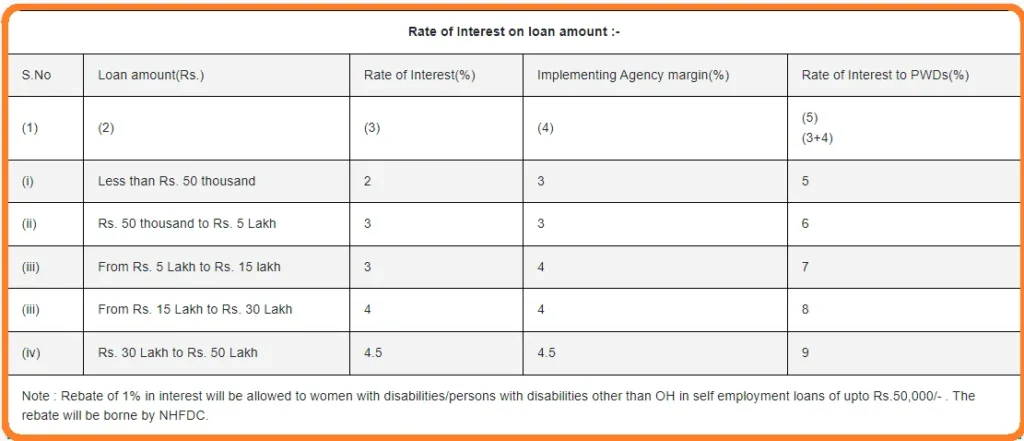

Amount of Loan and Rate of Interest for lending

Under various NHFDC schemes, the maximum concessional credit that can be provided to each beneficiary or unit is Rs. 50.0 lakhs. The specific loan amount within this upper limit of Rs. 50.0 lakhs will be decided by implementing agencies, taking into consideration the requirements of the project or activity being financed and the borrower’s ability to repay within the specified maximum repayment period.

Rebate: NHFDC will provide a 1% interest discount to women with disabilities or persons with disabilities other than those with orthopedic impairments for self-employment loans of up to Rs. 50,000.

Type of Loan

The nature of the loan could be

- Term loan

- Working capital loan

The term loan, a working capital loan, or a contribution by the promoter for loans approved by other financial institutions.

Loan Repayment: State Channelizing Agencies (SCAs) have the freedom to establish repayment schedules either based on specific activities or individual cases, as long as they adhere to the maximum limit of 10 years from the loan disbursement date.

Prepayment

The borrower has the option to make loan repayments at any point after the repayment period begins without incurring any prepayment fees.

Security

- Implementing Agencies should follow their policies to secure the necessary collateral, explore Central Government Guarantee schemes for under secured portions of the loan, and consider involving a family member defined in the Companies Act as a co-applicant to enhance loan security.

- Implementing agencies must ensure assets and beneficiaries are adequately insured. Beneficiary insurance costs should be covered by government and insurance company schemes for weaker sections. Asset insurance costs should be factored into the project’s total expenses and funded accordingly.

We can understand by these below simple way….

Implementing Agencies should make an effort to obtain necessary security in line with their policies. They may also explore Central Government Guarantee schemes to provide additional security for any portion of the loan that lacks sufficient collateral.

Additionally, the implementing agencies must secure sufficient insurance coverage for both the assets and beneficiaries.

How to apply for loan :-

Four Types of Detail Categories of Information are Needed

- Personal Details with Address

- Details of Disability

- Details of Employment

- Details of Identity

Documents Required For Applying For a UDID Card

- Recent color photograph in scanned format.

- Scanned address proof document, which can included

- Aadhar Card

- Pan Card

- Driving License

- Disability Certificate

Note: At this PwD registration Generation of UDID (Unique Disability ID) has been started.

You can check out this link for details:- Niramay : National Digital Health Mission (wecapable.in)

Rights of NHFDC, Procedure For Obtaining Loan & Other Terms and Conditions

To request a loan approval from the implementing agency, you must submit an application in the designated format, following the procedures and general terms and conditions established by the National Handicapped Finance and Development Corporation, which may be updated periodically.

Should any dispute arise, the final and binding decision will be made by the CMD (Chief Managing Director) of NHFDC.

The remaining terms and conditions of the Scheme will adhere to the guidelines issued by NHFDC for credit-based funding programs.

Contact Details

Address: –

Shri Vikash Prasad (Director)

Department of Empowerment of Persons with Disabilities,

Ministry of Social Justice & Empowerment

Room No. 5, B-I Block, Antyodaya Bhawan,

CGO Complex, Lodhi Road,

New Delhi – 110003 (India)

vikash.prasad@nic.in

Contact form for UDID Card – Contact form

UDID Login – Login

UDID Online Registration – Online Application

Divyangjan Swavalamban Scheme Details